Raise Smarter Money Kids the Safe, Fun Way

Story-based books that help children ages 5–11 learn saving, credit, and investing without pressure or confusion.

5-Star Rated, Approved by Parents and Experts

Teaching Kids About Money Shouldn’t Feel So Hard

As parents, we want our children to grow up confident, responsible, and prepared for the real world. But when it comes to money, most of us were never taught how to explain it…especially in a way kids can actually understand

Schools rarely cover real financial habits early.

And when they do, the lessons are often too complex, too boring, or completely disconnected from a child’s everyday life. So money becomes something kids learn too late…through mistakes.

Smarter Money For Kids changes that.

This book series introduces foundational money concepts through engaging, age-appropriate stories that children actually enjoy.

No pressure. No confusion. Just safe, simple lessons woven naturally into story time — so learning feels fun, familiar, and stress-free for both kids and parents.

The Smarter Money For Kids Series

Smarter Money For Kids is a 5-book story series designed to help children ages 5–11 learn the safe foundations of money — saving, using credit, and investing through fun, engaging stories they’ll enjoy.

What’s Included:

- 5 illustrated storybooks

- For children ages 5–11

- Covers saving, credit, and investing

- Available in physical and eBook formats

- Story-based learning (no lectures, no jargon)

Created to make financial learning feel natural, safe, and part of everyday story time, not another lesson kids want to avoid.

What’s Inside the Series

Each book introduces one core money idea through a fun, age-appropriate story — helping kids learn naturally, without being overwhelmed.

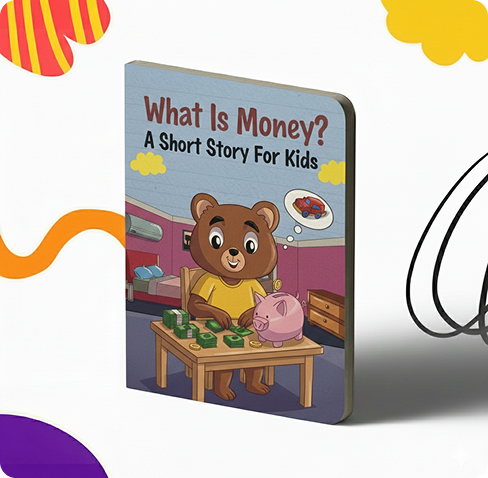

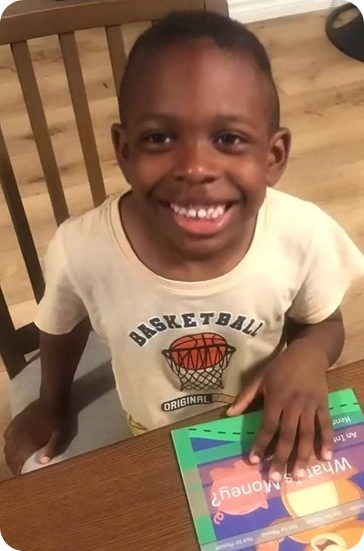

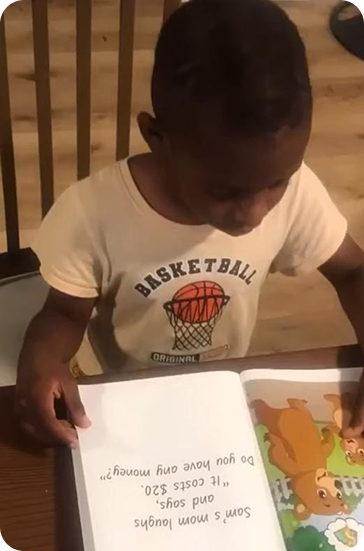

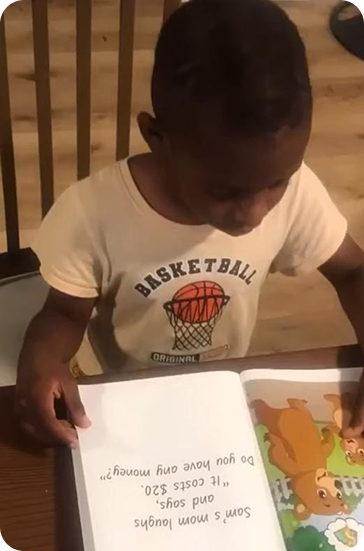

What Is Money? A Short Story For Kids.

A gentle introduction to what money is, how it’s earned, and why it matters; explained in a safe, fun, and family-friendly way

What Kids Will Learn

- What money is and why people use it

- How money is earned through work

- The value of helping and building good habits

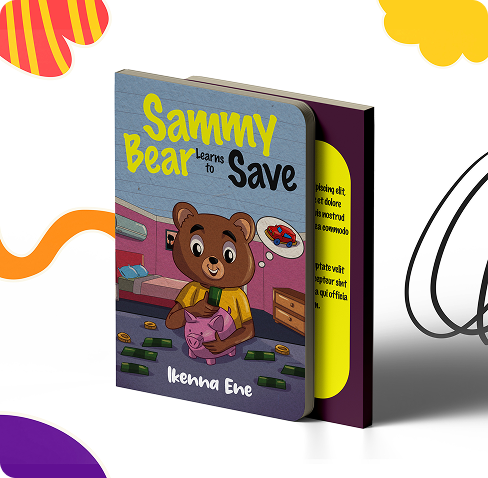

Sammy the Bear Learns to Save

Sammy learns why saving money helps him reach bigger goals and enjoy more meaningful rewards.

What Kids Will Learn

- What saving means and how to start

- Why waiting can be rewarding

- How small savings add up over time

Sammy the Bear Learns about Currency

A fun story that introduces the idea that different countries use different types of money.

What Kids Will Learn

- What currencies are and why they differ

- How money changes across countries

- Basic awareness of global cultures

Sammy the Bear Learns about Credit

Through a lemonade stand story, Sammy discovers how borrowing works and why keeping promises matters.

What Kids Will Learn

- What credit is and how it’s used

- The cost and responsibility of borrowing

- Basic entrepreneurial thinking

Sammy the Bear Learns to Invest

Sammy learns that money can grow when used wisely, and that asking questions helps make better choices.

What Kids Will Learn

- What investing means

- The idea of risk and reward

- How to think long-term about money

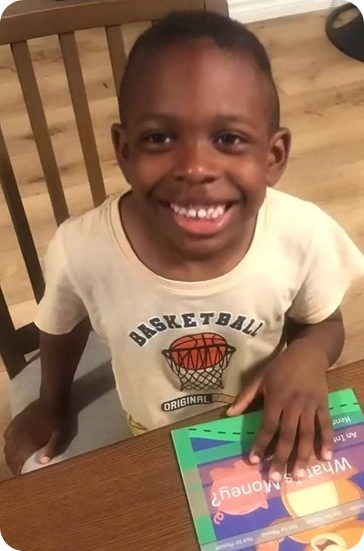

Trusted by Parents, Loved by Kids

Families and educators are using Smarter Money For Kids to introduce money concepts early — in a way that feels safe, simple, and enjoyable.

Not Just Another Children’s Finance Book

Most kids’ money books focus on information. Smarter Money For Kids focuses on understanding.

Most Children’s Finance Books

- Rely on dry explanations and rules

- Feel like schoolwork, not story time

- Overwhelm kids with concepts too early

- Require parents to translate the lesson

Smarter Money For Kids

- Teaches through fun, fictional stories

- Uses relatable characters kids connect with

- Introduces concepts gently and safely

- Feels natural for parents to read aloud

When kids enjoy the story, the lesson sticks — without pressure or confusion.

More Books, More Value

Many families choose to start with more than one book…so kids can grow their understanding step by step, without gaps.

Get 15% Discount

- Buy 5 or more books and get 15% off

- Ideal for siblings, gifts, or classroom reading

- Helps reinforce lessons through repeated exposure

Quick FAQ

Yes. The Smarter Money For Kids series is carefully written for children ages 5–11, using simple language, relatable fun stories, and age-appropriate examples.

Absolutely. All money concepts are taught in a safe, positive, and family-friendly way — without fear, pressure, or adult financial complexity.

Not at all. These books are designed to be read like regular storybooks. You don’t need to explain complex ideas or prepare lessons.

The series is available in physical books and eBook formats, so families can choose what works best for their reading routine.Yes. Families who purchase 5 or more books receive 15% off, making it easier to build a complete learning experience for siblings, gifts, or classroom use.

Yes. Families who purchase 5 or more books receive 15% off, making it easier to build a complete learning experience for siblings, gifts, or classroom use.

Start Your Child’s Smarter Money Journey Today

Give your child a confident, healthy relationship with money — taught through stories that feel safe, fun, and age-appropriate.

Smart Money For Kids is for educational purposes only. The stories are designed to introduce basic money concepts in a safe, age-appropriate way and are not financial, investment, legal, or tax advice. Parents should consult a qualified professional for real-world financial decisions.